Business Income Loss For Unprofitable Businesses

When an insured was unprofitable prior to a loss and is expected to continue operating unprofitably during the loss period, it can be easy to make mistakes when interpreting or applying business income loss coverage. To understand the root of these mistakes and ultimately appreciate the proper application of business income loss coverage, one must first understand the definition of business income. Most standard insurance policies define business income as:

1. Net income (net profit or loss before income taxes) that would have been earned or incurred; and

2. Continuing normal operating expenses, including payroll.

The readers of the policy sometimes conclude that an insured is at least entitled to recover the continuing expenses incurred during the loss period. The theory behind this argument is often the following: “since the coverage is two-pronged, the net income portion should be ignored because an unprofitable business does not have net income. Ignoring the net income portion leaves the coverage as continuing expenses.” Interpreting the policy to include only continuing expenses for an unprofitable business results in an erroneous business income loss determination. Such reasoning is also inconsistent with the wording of the policy.

From a policy standpoint, the coverage clearly states net profit or loss. Therefore, if the insured was expected to incur an operating loss during the restoration period, the business income loss calculation should begin with a negative number. Next, the policy contains the conjoining word “and” which explicitly states that the net operating loss (a negative number) should be combined with continuing expenses. Therefore, the resulting net number is less than continuing expenses alone. Thus, an insured is not entitled to recover its continuing expenses.

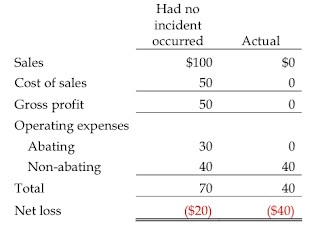

As stated above, the notion that an unprofitable business is at least entitled to recover continuing expenses under the business income loss policy is inconsistent with the wording of the policy. When an unprofitable business experiences an interruption, a business income loss recovery consisting of only continuing expenses makes the insured better-off than if no interruption occurred. Thus, reasoning that an unprofitable insured is always entitled to a recovery at least equal to its continuing expenses is flawed from an economic standpoint. To understand the issue from an economic standpoint, consider the following scenario for an unprofitable business:

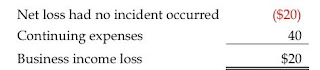

Under this scenario, the insured’s continuing expenses are $40. Hence, one may believe that the business income loss recovery should at least be $40. However, the correct application of the policy is shown below:

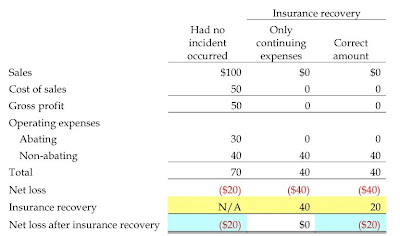

As shown, the business income loss is $20, which is less than continuing expenses of $40. A $40 recovery would make the insured better off than if no loss occurred, which is inconsistent with the intent of the policy. The “better off” position is illustrated below:

As shown in the table above, if no incident occurred, the insured would have experienced a net loss of $20. If, as a result of the loss, the insured received $40 for continuing expenses, it would achieve a break-even, as opposed to losing $20. Accordingly, a recovery of only continuing expenses over-indemnifies the insured.

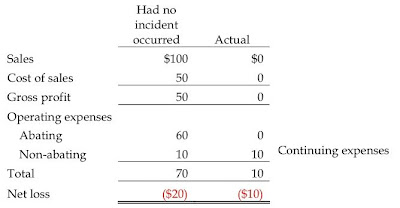

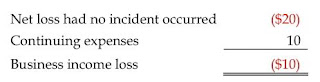

The above scenario showed that an unprofitable business can experience a business income loss. However, in the event that the insured is unprofitable and abated expenses exceed continuing expenses, the insured does not sustain a business income loss. An example of such a situation is shown below:

Based on the figures reflected in the table above, the business income loss is calculated as follows:

As shown, the insured was expected to lose $20 had no incident occurred. However, the insured actually lost $10 (the amount of continuing expenses). Thus, because of the un-profitability of the business and the cost structure, the business was better off following the incident. Therefore, there is no business income loss.